ESI

ALL ABOUT ESI

HOW DOES THE ESI REGISTRATION SCHEME HELP EMPLOYEES?

Get in Touch

WHO REQUIRES ESIC REGISTRATION?

- ESI Registration is mandatory for every factory and specified establishments who have 10 or more permanent employees and wages of such employees are less than Rs. 21,000/- per month.

IS IT MANDATORY FOR THE EMPLOYER TO REGISTER UNDER THE SCHEME?

- Yes, it is the statutory responsibility of the employer under Section 2A of the Act read with Regulation 10-B, to register their Factory/ Establishment under the ESI Act within 15 days from the date of its applicability to them.

DEFINITION OF ESTABLISHMENT

According to the notification issued by the appropriate Government (Central/State) under Section 1(5) of the Act, the following establishments employing 10 or more persons attract ESI registration coverage

- Shop

- Hotels or restaurants not having any manufacturing activity, but only engaged in 'sales';

- Cinemas including preview theaters;

- Road Motor Transport Establishments;

- Newspaper establishments. (that is not covered as a factory under Sec.2(12));

- Private Educational Institutions (those run by individuals, trustees, societies or other organizations and Medical Institutions (including Corporate, Joint Sector, trust, charitable, and private ownership of hospitals, nursing homes, diagnostic centers, pathological labs).

PENALTY IN CASE OF FAILURE TO GET ESI REGISTRATION & ESI RETURNS

- In case of any non-compliance by an employer, such as failure to get esic employer registration online or not fulfilling esi return filing procedure, he shall be liable for a fine of INR 10,000/-.

BENEFITS OF ESIC REGISTRATION

ESI Registration provides monetary and medical benefits to employees in case of sickness, maternity and employment injury and to make provisions for related matters.

Some of the benefits of ESI Registration are :

- Sickness benefits at the rate of 70% (in the form of salary), in case of any certified illness certified and which lasts for a maximum of 91 days in any year

- Medical Benefits to an employee and his family members

- Date of company incorporationMaternity Benefit to the women who are pregnant (paid leaves)

- If the death of the employee happens while on work – 90% of the salary is given to his dependents every month after the death of the employee

- Same as above in case of disability of the employee

- Funeral expenses

- Old age care medical expenses

ESI CONTRIBUTION OF EMPLOYER AND EMPLOYEES

Every month, employers are required to contribute 3.25 % and employee contributes 0.75% of the wages payable. Total ESI contribution i.e. 4% deposited to the ESIC fund.

Total ESI contribution is 4%

ESI contribution rates for employee and employers are as below

|

Employee |

Employers |

|

3.25% |

0.75% |

ESI RETURNS TO BE FILED BY THE EMPLOYER

All the business entities having an ESIC Registration need to do regular ESI return filing.

The following below are ESI returns as follows:

|

ESI Returns |

Interval |

Due Date |

|

Form 5 |

Half Yearly |

April to September: 11th November October to March: 11th May |

|

Form 1a |

Annually |

31st January |

ESI REGISTRATION PROCESS

Upload the Necessary Documents on our web portal.

Choose the appropriate Package and Pay online with various payments modes available.

On placing the order, your application will be assigned to one of our dedicated professionals.

Our professional will fill up the required ESI registration form for the employee.

Upon verification, the ESI registration form will be submitted.

After ESI account is created, the ESI registration certificate will be sent to the applicant.

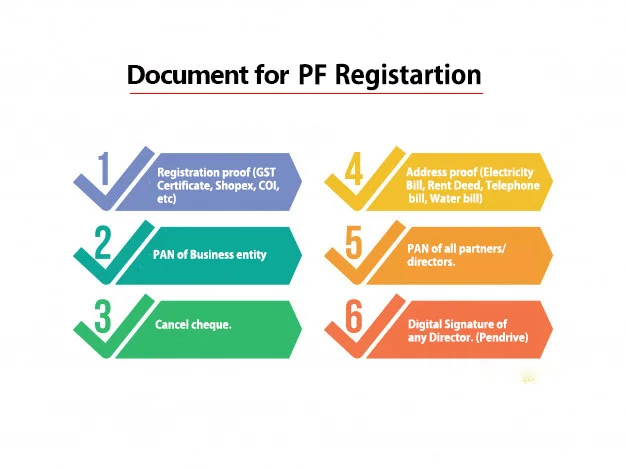

DOCUMENTS REQUIRED FOR ESI REGISTRATION

- Registration Certificate GST Certificate, Shopex, COI

- Address proof Electricity Bill, Rent agreement, Telephone Bill, Water bill.

- PAN card Of business entity and all partners/directors.

- Canceled cheque Cancelled cheque is required for authentication of bank details.

- Digital Signature of anyone Director. (Pendrive) DSC will be affixed on the application form.

- Additional Document Additional Document In case of Company - COI/MOA, In case of partnership firm - Partnership deed.