PF

WHAT IS EPF?

Get in Touch

WHY GET EPF ONLINE REGISTRATION FOR EMPLOYER?

- PF Registration is mandatory for all the organizations that have 20 or more employees. Such organizations are required to contribute a fixed amount towards Employee Provident Fund out of employee salary and wages.

- If an employer fails to get EPF employer registration, or indulges in false representation of facts to avoid PF payment, he shall be liable for a penalty of INR 5,000/-.

WHEN IS PF REGISTRATION FOR EMPLOYER MANDATORY?

PF registration for Employer is compulsory if:-

- He owns a factory having 20 or more people.

- Any other organization / foundation with 20 or more employees

- The class of such organizations whom the Central Government may, by notice would specify for compulsory EPF employer registration.

WHAT DETAILS DO I NEED TO GIVE FOR PF REGISTRATION?

Employers need to furnish the following details to get PF registration.

- Name & address of your company

- Head office & branch details

- Date of company incorporation

- Total employee strength

- Type of business activity

- Nature of business.

- Director/partners’ details

- Employee’s Basic details

- Employees’ salary details

- Bank account details of the company

- PAN card

WHAT ARE THE BENEFITS OF EPF REGISTARTION ?

Given below are the benefits of getting EPF registration:

- Risk coverage: The most fundamental benefit of the Provident Fund is to cover the risks employees and their dependents that may arise due to retirement, an illness or their demise.

- Uniform account: One of the most important aspects of the Provident Fund account that it's steady and transferable. It can be carried forward to any other place of employment.

- Employee Deposit Linked Insurance Scheme: This scheme is for all the PF account holders. According to it, 0.5% of the salary is deducted from the life insurance premium.

- Long-term goals: There are many long-term goals such as Marriage or higher education that require the urgent availability of funds. The accumulated PF amount often comes handy during such occasions.

- Emergency needs: Emergency needs: There are certain unanticipated occasions like marriage or other family occasions, any mishappening or illness that require urgent finance. The PF amount can be of great help.

- Covers pension: Apart from the employee’s 12% contribution towards EPF, an equal amount is contributed by the employer, which includes 8.33% towards Employee Pension Scheme (EPS).

WHAT DO WE MEAN BY UAN NUMBER?

WHO APPLIES FOR UAN NUMBER REGISTRATION?

WHAT IS PF RETURN FILING PROCEDURE?

WHAT IS THE DUE DATE FOR PAYMENT OF PF BY EMPLOYER?

Penalty for delay in PF payment by employer:

Delay in payment of PF by employer having PF registration will attract penalty as follows:

|

S.No |

Period of Delay |

Rate of Penalty (p.a.) |

|

1. |

Upto 2 months |

5% |

|

2. |

2 - 4 months |

10% |

|

3. |

4 - 6 months |

15% |

|

4. |

Beyond 6 months |

25% |

OUR PROCESS

Upload the required documents & information to our web portal

Choose Package and Pay online with different payments modes available

On placing an order, your application will be assigned to one of our dedicated professionals.

Our professional will prepare the required PF registration form.

Upon verification, the PF registration form will be submitted to PF department.

PF registration certificate shall be generated and provide you over the mail.

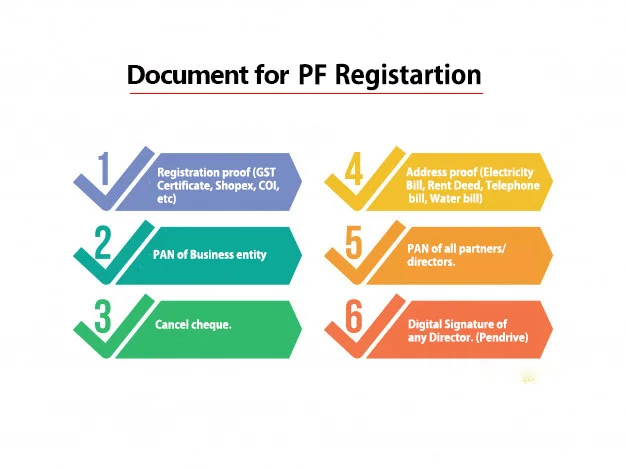

DOCUMENTS REQUIRED FOR PF REGISTRATION

- Registration Certificate GST Certificate, Shopex, COI

- Address proof Electricity Bill, Rent agreement, Telephone Bill, Water bill.

- PAN card Of business entity and all partners/directors.

- Canceled cheque Cancelled cheque is required for authentication of bank details.

- Digital Signature of anyone Director. (Pendrive) DSC will be affixed on the application form.

- Additional Document Additional Document In case of Company - COI/MOA, In case of partnership firm - Partnership deed.